top of page

by Square League

The RBI rate cut could save you Lakhs on your loan... If you use it right. The answer

When the RBI cuts interest rates, home loan borrowers usually expect one thing. A lower EMI. Banks are happy to offer that. A smaller monthly payment feels like relief. But very few borrowers pause to ask a more important question. Is this actually the best way to use a rate cut?

Kiran S N

Dec 19, 20253 min read

RBI’s new rule could reduce your EMI sooner and here’s how...

Earlier, when you took a home loan, your bank fixed something called the ‘spread’, the bank’s margin over the benchmark rate (like the repo rate). Even if your credit score got better, the bank couldn’t change this spread for three years after the loan was issued.

Kiran S N

Nov 7, 20252 min read

Was Your Money at Risk? How the RBI's Measurement Protected Your Money

Imagine this: you’re at an auction, and the bidding is happening at lightning speed. The price of everything keeps climbing higher and higher. It’s exciting at first, but then you start to wonder, how long can this last before things go out of control? That’s what was happening in India’s unsecured lending sector in 2023. Loans were being given out faster than ever, with little thought to the consequences down the road. It felt like the good times would never end. But just li

Remin Francis I R

Oct 13, 20253 min read

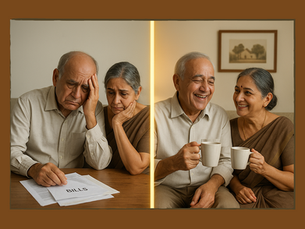

How can I support my parents financially? A Reverse Mortgage could be your answer

Think of it as a home loan in reverse. Instead of you paying EMIs to a bank, the bank pays you either monthly, quarterly, or as a lump sum against the value of your house or apartment.

Kiran S N

Jul 23, 20254 min read

Women in India Have a 98% Loan Repayment Rate. Here’s Why?

Think India’s best borrowers are wealthy city dwellers? Think again. Rural women in Self-Help Groups (SHGs) boast a stunning 98% loan repayment rate, and they’re doing it without traditional collateral. This post uncovers the powerful blend of social trust, peer accountability, and grassroots financial discipline that makes India’s SHG model a global standout.

Remin Francis I R

Jul 21, 20252 min read

Where Does Your Bank Deposits Go? You Could Be Funding India’s Growth Without Even Knowing It

India’s banking landscape hides surprising regional gaps. Which states lend far more than others? Discover what these credit patterns reveal about the country’s hidden growth opportunities. Over the last two decades, India’s banking sector has undergone a significant transformation. While overall deposit and credit volumes have grown impressively, a deeper look through the lens of the Credit-Deposit (CD) Ratio reveals a story of regional divergence. This ratio, which reflects

Remin Francis I R

May 29, 20252 min read

bottom of page