top of page

by Square League

Personal Finance

SIFs Explained: Why India’s Smart Money Is Moving Beyond Mutual Funds

Specialised Investment Funds (SIFs), launched in mid-September 2025 for investors with a high risk appetite, have already clocked 20,779 investor folios by the end of December, according to data from AMFI. That’s a big jump in a very short time.

Gabriela Galeena

Jan 164 min read

The RBI rate cut could save you Lakhs on your loan... If you use it right. The answer

When the RBI cuts interest rates, home loan borrowers usually expect one thing. A lower EMI. Banks are happy to offer that. A smaller monthly payment feels like relief. But very few borrowers pause to ask a more important question. Is this actually the best way to use a rate cut?

Kiran S N

Dec 19, 20253 min read

Rupee down again. These assets turn that problem into profit

Indian investors face one steady challenge. The rupee keeps losing value against the dollar. In 2015, USD INR was ₹66, and today it is around ₹89. That means the rupee has weakened by 34% in ten years. Even a small 3% to 4% depreciation every year becomes a big loss over time. It quietly reduces the real returns on all rupee investments. This is why more investors are looking for assets that protect them from this continuous slide. Why S&P 500 Feeder Funds Work Well S&P 500 f

Mani Metto

Nov 24, 20253 min read

Is your Gold safe? Think again, the real risk lies in something called digital gold.

It sounds like the perfect idea. Buy gold with just a few taps on your phone, skip the jeweller, and own pure 24K gold stored safely in a vault somewhere. That is the promise of digital gold, and it has taken India by storm.

Kiran S N

Nov 12, 20253 min read

How to find potential Multibagger stocks before everyone else does?

What if you could have spotted Kalyan Jewellers before it doubled?

Turns out, there’s a smart way to catch such moves early...not by insider tips or luck, but by quietly tracking where some of India’s best fund managers are placing their bets.

Kiran S N

Nov 10, 20252 min read

RBI’s new rule could reduce your EMI sooner and here’s how...

Earlier, when you took a home loan, your bank fixed something called the ‘spread’, the bank’s margin over the benchmark rate (like the repo rate). Even if your credit score got better, the bank couldn’t change this spread for three years after the loan was issued.

Kiran S N

Nov 7, 20252 min read

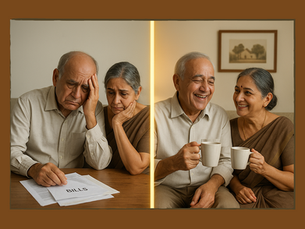

Crush Your Debt: 3 Simple Strategies to Get Debt-Free Faster

Feeling weighed down by debt? You’re not alone. Between the total amount you owe and the never-ending interest payments, it can feel like a huge mountain to climb. But the good news is, you can conquer that mountain. All you need is a plan. The key to getting out of debt isn't just about making payments; it's about making them strategically. Let's break down three popular and proven methods to help you pay off your debt faster and take back control of your finances. To make t

Remin Francis I R

Nov 5, 20254 min read

How to earn passive income from Stocks in India? Steps to find high dividend paying stock.

How do you find the right dividend-paying stocks in India? Here’s a simple, data-driven way to do it using screener.in, one of India’s most popular stock research tools.

Kiran S N

Nov 3, 20252 min read

The SME IPO Craze: Gold Rush or Risky Bet?

If you follow the stock market, you’ve probably heard the buzz: SME IPOs. Stories of small, unknown companies listing on the stock exchange and their prices doubling, or even tripling, on the very first day are everywhere. It feels like a modern-day gold rush where anyone with a demat account can strike it rich. But is it really that simple? A recent in-depth study from the Reserve Bank of India (RBI) helps us look behind the curtain of this frenzy. Let's break down what’s ha

Remin Francis I R

Oct 22, 20254 min read

Planning to Gift Mutual Funds to Loved Ones? Read this before making any decisions.

Mutual funds are an excellent way to invest and build wealth over time. However, there are situations when you may want to transfer your mutual fund units, whether it's to a family member, a friend, or even after a life-changing event. In this blog post, we’ll explore how you can use a facility for mutual fund units held in a non-dematerialised format, an online-only facility to transfer or gift your mutual fund units. If you've ever wondered how to simplify your transfers,

Remin Francis I R

Oct 15, 20254 min read

Worried About Market Crashes? Try the Permanent Portfolio Strategy

Investing in today's world can often feel like navigating through unpredictable weather. Whether it’s a booming economy, a demonetization shock, or a sudden market downturn, economic conditions can shift rapidly. But what if there was a way to make your investment strategy resilient across all seasons? Enter the "Permanent Portfolio", a simple yet powerful strategy designed to protect and grow your wealth, regardless of the economic climate. What is the Permanent Portfolio? T

Remin Francis I R

Oct 10, 20254 min read

Foreign Funds Are Selling. What Does That Mean for Your Portfolio?

If you’ve been tracking the Indian stock market lately, you may have noticed a strange split in investor behaviour. On one side, foreign investors are heading for the exit. On the other hand, Indian investors, both big institutions and everyday savers, are stepping in with unshakable confidence. It’s a tug of war, and the story behind it reveals a fundamental shift in the Indian market. The Great Divide- A Tale of Two Investors Foreign Portfolio Investors (FPIs) have been in

Remin Francis I R

Sep 29, 20253 min read

The Death of the Fixed Deposit? A Nation of Savers Relearns How to Invest

For decades, the answer to every Indian saver’s question “Where should I put my money?” was almost automatic: Fixed Deposit. Today, that answer is no longer so simple.

Remin Francis I R

Sep 17, 20253 min read

3 Essentials Every Investor Should Keep in Mind During Corrections. Investment strategies for corrections

The first instinct for many investors is to hit the sell button, but history shows that panic selling is the costliest mistake. Corrections typically last three to six months, after which markets recover. The smarter approach is to align your strategy with your investor personality.

Kiran S N

Sep 12, 20254 min read

How can I support my parents financially? A Reverse Mortgage could be your answer

Think of it as a home loan in reverse. Instead of you paying EMIs to a bank, the bank pays you either monthly, quarterly, or as a lump sum against the value of your house or apartment.

Kiran S N

Jul 23, 20254 min read

Women in India Have a 98% Loan Repayment Rate. Here’s Why?

Think India’s best borrowers are wealthy city dwellers? Think again. Rural women in Self-Help Groups (SHGs) boast a stunning 98% loan repayment rate, and they’re doing it without traditional collateral. This post uncovers the powerful blend of social trust, peer accountability, and grassroots financial discipline that makes India’s SHG model a global standout.

Remin Francis I R

Jul 21, 20252 min read

Losing money in the stock market? Don't fall in the Micro-Cap trap.

By March 2025, individuals owned 19.3% of the total market cap of micro-cap stocks. That’s already a big number. But here's the kicker: when we look only at non-promoter holdings, that is, shares available to the public, retail investors control over 70%. That’s a staggering concentration.

Remin Francis I R

Jul 14, 20253 min read

Do NRIs have to pay tax on mutual funds?

Without specific DTAA provisions deeming them as shares or explicitly making their gains taxable in India, they cannot be taxed under the same article as shares.

Kiran S N

Jun 22, 20254 min read

How Indian banking trends are reshaping where people park their savings

Over the past five years, India's banking landscape has quietly transformed. While term deposits continue to grow, the balance of where people choose to park their savings is shifting. This post explores the reasons behind this trend, what it means for depositors, and why your money remains safe, regardless of where you bank.

Remin Francis I R

Jun 19, 20252 min read

Kerala EMI Crisis: How Rising Debts Are Hurting Families and What You Can Do to Reduce This.

The state's debt-to-asset ratio (DAR), which compares how much debt a household has to its assets, shows a worrying trend. According to the NSS report(2019), the rural households in Kerala had a DAR of 9.7%, while urban households had a ratio of 7.3%.

Remin Francis I R

Jun 7, 20252 min read

bottom of page