Kerala EMI Crisis: How Rising Debts Are Hurting Families and What You Can Do to Reduce This.

- Remin Francis I R

- Jun 7, 2025

- 2 min read

Updated: Jun 16, 2025

Smart Financial Moves to Break Free from the Debt Trap

In Kerala, many families are facing the pressure of rising debts and higher monthly payments, known as EMI (Equated Monthly Instalments). The state's debt-to-asset ratio (DAR), which compares how much debt a household has to its assets, shows a worrying trend. According to the NSS report(2019), the rural households in Kerala had a DAR of 9.7%, while urban households had a ratio of 7.3%. These figures are significantly higher than the national rural average of 3.8% and also higher compared to nearby states. Karnataka’s rural DAR is 4.9% and Tamil Nadu’s is 5.6%, highlighting the heavier debt burden faced by households in Kerala. In this article, we will also look at ways to reduce EMI.

So, why are EMI rising in Kerala? A major factor is the growing reliance on loans for everyday needs like home loans, personal loans, and education loans. As borrowing increases, so do the EMI that families must pay each month. Additionally, interest rates on loans have been rising, which directly pushes up the EMI amount. On top of this, the cost of living, especially in cities like Kochi and Thiruvananthapuram, has been rising, making it harder for families to manage expenses without taking loans. Many also resort to credit cards and personal loans for extra spending, which adds to the debt load.

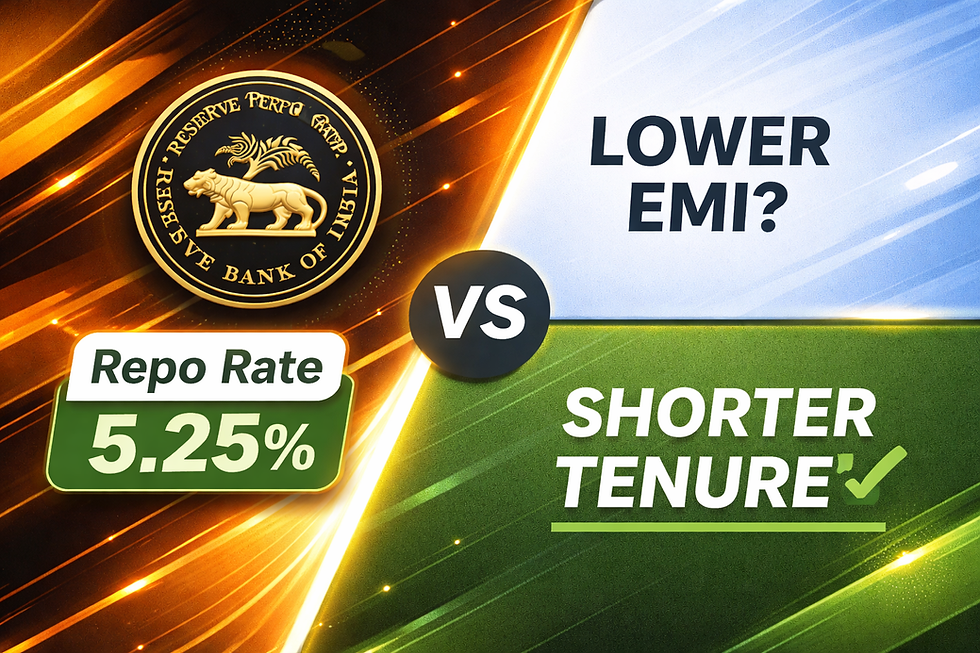

However, there are several ways to reduce the burden of rising EMIs. Refinancing loans to get a lower interest rate is one option, as it can help lower monthly payments. Another useful strategy is debt consolidation, which combines multiple loans into one with a lower interest rate, making it easier to manage. Families should also focus on paying off high-interest debts, such as credit card balances, before tackling lower-interest loans like home loans. Additionally, cutting down on unnecessary spending and creating a clear budget can free up more money to pay down debt faster. These are key steps for anyone asking, "How can I reduce my EMI in Kerala without compromising on basic needs ?".

In conclusion, the rising debt burden and increasing EMIs in Kerala are significant challenges for many families. However, with careful financial planning and proactive steps, it is possible to manage and reduce this pressure. Making informed choices today can pave the way for a more stable and debt-free tomorrow.

Comments