top of page

by Square League

The RBI rate cut could save you Lakhs on your loan... If you use it right. The answer

When the RBI cuts interest rates, home loan borrowers usually expect one thing. A lower EMI. Banks are happy to offer that. A smaller monthly payment feels like relief. But very few borrowers pause to ask a more important question. Is this actually the best way to use a rate cut?

Kiran S N

Dec 19, 20253 min read

RBI’s new rule could reduce your EMI sooner and here’s how...

Earlier, when you took a home loan, your bank fixed something called the ‘spread’, the bank’s margin over the benchmark rate (like the repo rate). Even if your credit score got better, the bank couldn’t change this spread for three years after the loan was issued.

Kiran S N

Nov 7, 20252 min read

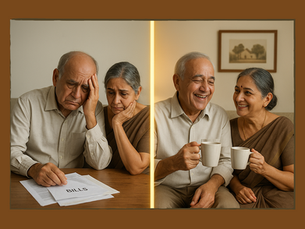

How can I support my parents financially? A Reverse Mortgage could be your answer

Think of it as a home loan in reverse. Instead of you paying EMIs to a bank, the bank pays you either monthly, quarterly, or as a lump sum against the value of your house or apartment.

Kiran S N

Jul 23, 20254 min read

Kerala EMI Crisis: How Rising Debts Are Hurting Families and What You Can Do to Reduce This.

The state's debt-to-asset ratio (DAR), which compares how much debt a household has to its assets, shows a worrying trend. According to the NSS report(2019), the rural households in Kerala had a DAR of 9.7%, while urban households had a ratio of 7.3%.

Remin Francis I R

Jun 7, 20252 min read

bottom of page