Quant Small Cap Holders, Do You Know ? Your Fund has India's Highest 5-Year Returns, But Also Its Lowest 1-Year.

- Kiran S N

- May 25, 2025

- 5 min read

Its 1-year return is among the lowest in the small-cap category, at a modest -5.41%. Yet, flip the coin and look at its 5-year return, and you'll find it leading the pack with an impressive 48.30%.

When most of us embark on the journey of analyzing mutual funds – any fund, for that matter, but let's stick to small-cap funds for now – the first, and perhaps, often the only, metric we tend to scrutinize is performance. While looking at returns is inherently not a bad thing, making your final investment decision based solely on a single performance snapshot can prove to be financially costly.

Let's delve into why, using a compelling case study.

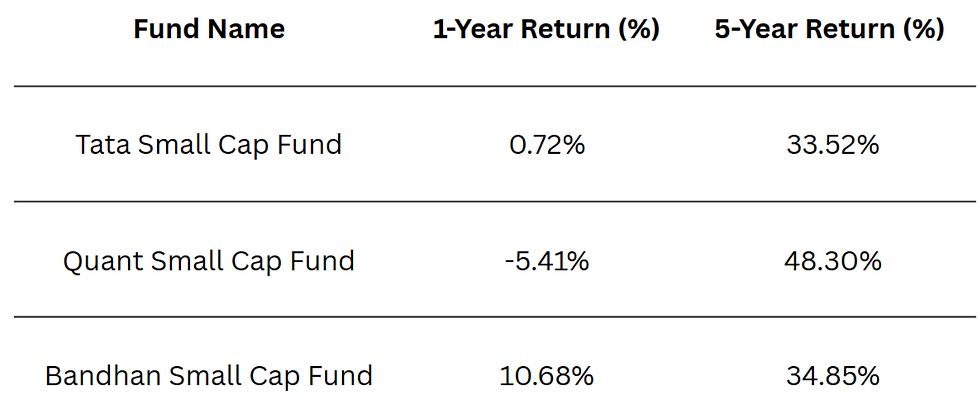

Enter the Quant Small Cap Fund. Take a glance at its recent performance (based on April 2025). You'll notice a curious paradox: its 1-year return is among the lowest in the small-cap category, at a modest -5.41%. Yet, flip the coin and look at its 5-year return, and you'll find it leading the pack with an impressive 48.30%. This striking contrast – short-term lag versus long-term leadership – is quite bizarre, isn't it?

To truly appreciate this, let's briefly compare it with some other popular funds in the category. The Bandhan Small Cap Fund, for instance, has delivered a healthy 1-year return of 10.68%, while its 5-year return stands at 34.85%. Similarly, the Tata Small Cap Fund shows a 1-year return of 0.72% and a 5-year return of 33.52%. These funds exhibit a more consistent performance across both horizons, making Quant's pattern particularly intriguing.

So, why this seemingly bizarre behaviour from Quant Small Cap Fund?

Want to read more?

Subscribe to finsightsbysquareleague.com to keep reading this exclusive post.