Kerala’s Muthoot Finance becomes the first listed Company from the state to cross ₹1 Lakh Crore Market Cap

- Remin Francis I R

- Jun 10, 2025

- 2 min read

Updated: Jun 16, 2025

On June 9th, 2025, Muthoot Finance made a significant mark in India's financial history by becoming the first listed company from Kerala to surpass a market capitalisation of ₹1 lakh crore. This milestone is not just a reflection of the company’s growth but also of its key role in shaping the landscape of non-banking financial companies (NBFCs) in India.

Muthoot Finance, primarily known for its gold loan business, has steadily grown in both size and influence. As of the latest figures, the company boasts a market cap of ₹1,02,229 crore, with its share price standing at ₹2,546. This achievement comes amid a period of favourable regulatory changes, particularly the Reserve Bank of India’s decision to raise the loan-to-value (LTV) ratio for gold loans. By allowing financiers to lend more against the same amount of collateral, this move provides a significant boost to companies like Muthoot that have a strong foothold in the gold loan business.

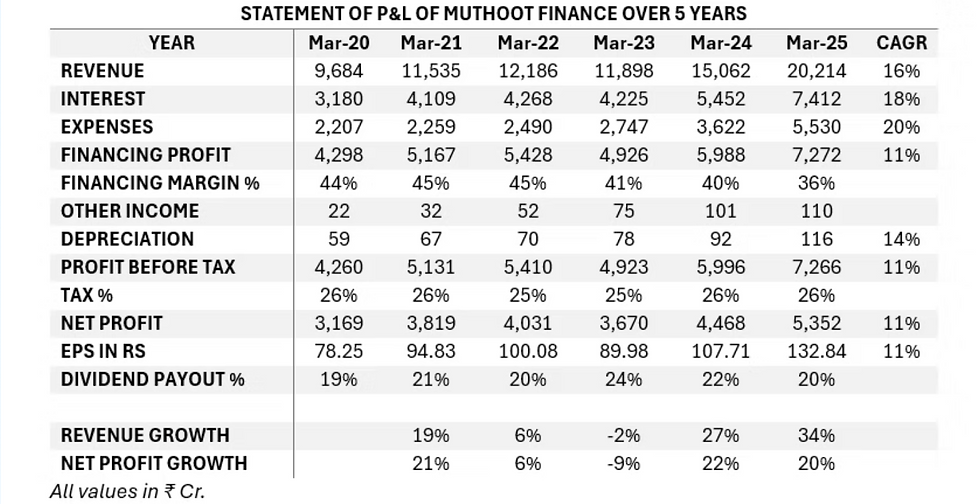

Looking at its financial performance, Muthoot Finance has demonstrated consistent growth over the past few years. In FY24, the company reported a revenue of ₹15,062 crore, a 16% increase from the previous year. Net profit for the same period reached ₹4,468 crore, marking a growth of 20%. The company also follows a stable dividend payout policy, with a consistent track record of rewarding shareholders.

When compared to its peers in the gold loan sector, such as Manappuram Finance and IIFL Finance, Muthoot Finance has outperformed in terms of stock price returns, with a 22% annual growth over the last five years. This solid performance has garnered attention from investors, cementing Muthoot Finance’s position as one of the most trusted names in the NBFC space.

However, as with any investment, potential investors should consider both the opportunities and risks. While Muthoot Finance has demonstrated strong financial growth and a solid business model, it is always important to perform thorough research and analysis before making investment decisions.

While Muthoot Finance’s achievement of crossing ₹1 lakh crore in market capitalisation is a notable milestone, it’s essential to keep in mind that such growth reflects both the company’s strengths and the dynamics of the broader financial sector. While the company has shown impressive performance and remains a key player in the gold loan market, potential investors should approach with a balanced view, considering both the opportunities and the risks involved in the sector. As Muthoot Finance continues to adapt to regulatory changes and market conditions, it will be interesting to see how it navigates future challenges and opportunities in the ever-evolving financial landscape.

Disclaimer: This content is for educational purposes only; please conduct your research and consult with a qualified investment advisor before making any investment decisions.

Research: Joshwa Joji

LinkedIn: http://linkedin.com/in/jjoji

Want to read more?

Subscribe to finsightsbysquareleague.com to keep reading this exclusive post.