Kerala’s Hot Crisis, India’s Cool Inflation

- Remin Francis I R

- Aug 13, 2025

- 2 min read

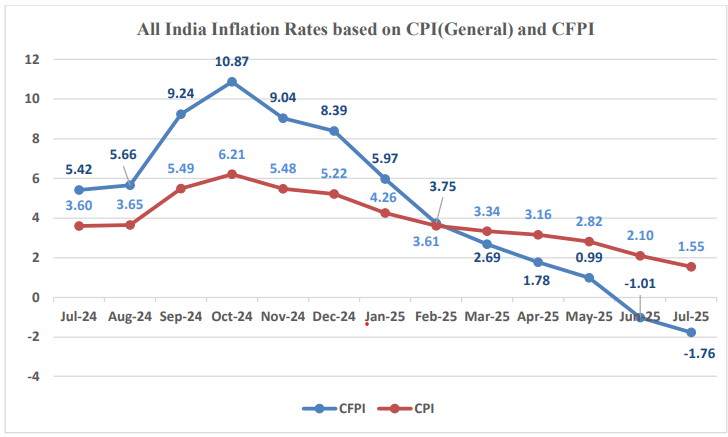

For the first time in years, there’s a significant sign of relief for household budgets across India. The country’s headline inflation rate (CPI) dropped to just 1.55% in July 2025, the lowest since June 2017. That’s a big deal in a nation where prices have often felt like they only move one way: up.

Even better news? Food inflation has gone negative at -1.76%. In plain words, on average, the basket of food items you buy today is cheaper than it was a year ago. Vegetables, pulses, and edible oils have seen major price corrections. It’s a rare moment when your wallet feels heavier after a grocery trip.

So why the sudden cool-off? The national numbers are being pulled down mainly by a steep decline in vegetable prices (down more than 20%), pulses (down nearly 14%), and stable rates in essentials such as fuel and transport. A quick look at the official chart tells the story: the Red CPI line has eased gently, but the Blue CFPI line, tracking food, has plunged deep into negative territory.

But this national calm hides a storm brewing in one corner of the country. In Kerala, inflation is raging at 8.89%, a completely different economic reality. Rural Kerala is hit hardest at 10.02%, while urban areas are at 6.77%. Coconut oil, a staple in every Keralite kitchen, has skyrocketed 131.77% in price nationally. Add to that big jumps in personal care products (up 15.12%) and the state’s long-term trend of higher prices for pulses and spices, and you’ve got a persistent cost-of-living crunch.

If you look at the “winners and losers” in July’s price game, the relief items are clear: onions (-34.86%), potatoes (-34.35%), tomatoes (-34.17%), and arhar/tur dal (-28.03%). On the pain side: coconut oil (+131.77%), gold (+36%), mustard oil (+19.92%), and personal care products (+15.12%).

What does this mean for you?

National inflation is at an 8-year low (1.55%).

Food prices, especially vegetables and pulses, are down for most households.

Kerala stands out as a high-inflation hotspot, driven by local consumption patterns and supply shocks.

Low inflation nationwide could give the RBI room to consider interest rate cuts, but such stark regional disparities mean policy will have to tread carefully.

Want to read more?

Subscribe to finsightsbysquareleague.com to keep reading this exclusive post.